“Dubai’s remarkable growth is the product of shrewd investments, business-friendly tax and regulatory rules”

In just fifty years, Dubai has transformed from an obscure fishing village into a city of global significance.

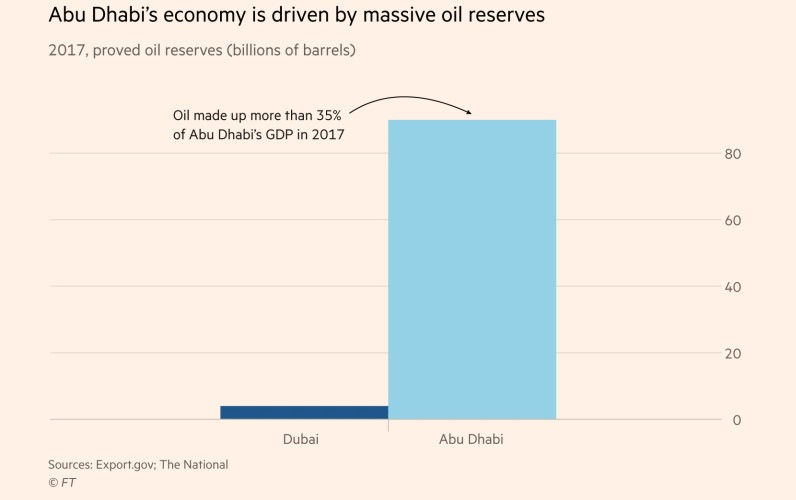

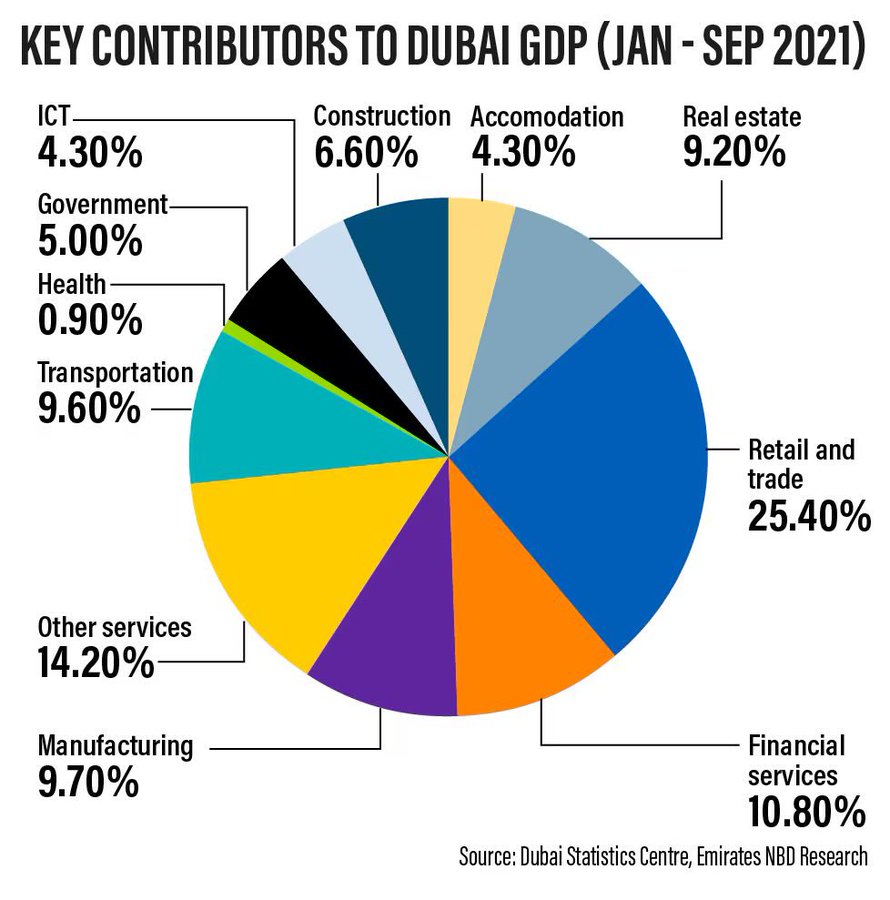

Despite popular misconceptions, oil revenues contribute less than 1% of Dubai’s GDP today. You read that right – unlike nearby Abu Dhabi, Dubai’s economy is not powered by oil revenues. In fact, Dubai’s remarkable growth is the product of shrewd investments, business-friendly tax and regulatory rules, and an uncompromising approach to political stability.

Modern Dubai was founded as a fishing village on the Persian Gulf at some point in the 18th century. Throughout the early 19th century, Dubai – as well as other neighbouring Gulf states – fell under British influence. In 1820, these small Gulf states fell under a British protectorate.

“In 1901, Sheikh Makhtoum bin Hasher Al Makhtoum established Dubai as a free port, with no tariffs on imports or exports”

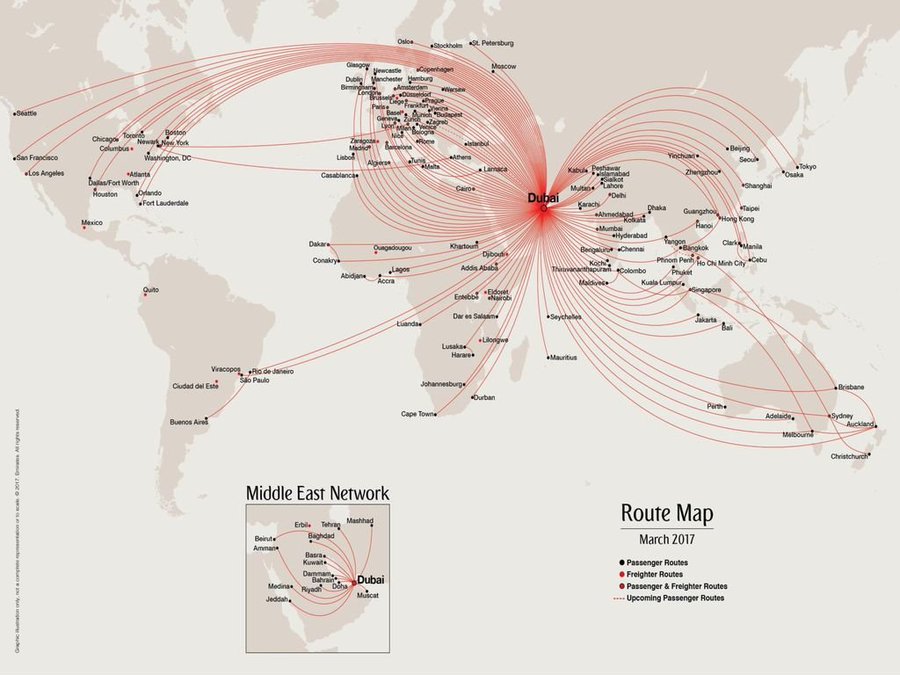

As early as 1900, Dubai began to emerge as an important port. Its location at the mouth of the Persian Gulf made it ideal for trading into the Middle East, India, and East Africa. This geographic advantage, and its openness to commerce, has been the secret to Dubai’s success.

In 1901, Sheikh Makhtoum bin Hasher Al Makhtoum established Dubai as a free port, with no tariffs on imports or exports. Merchants, particularly those working in the pearl industry, were given parcels of land, guarantees of protection, and religious toleration.

In the first half of the 20th century, Dubai grew in importance as a hub for trade with Persia and India. However, the city’s position was supercharged with the emergence of a new leader. In 1957, Rashid bin Saeed Al Makhtoum succeeded his father to become ruler of Dubai.

Sheikh Rashid understood the young city’s potential. He set about transforming Dubai from a small coastal settlement into a modern port city. He also understood the keys to Dubai’s success – openness to trade, infrastructure investments, stability and order.

“In 1966, more gold was shipped from London to Dubai than almost anywhere in the world”

He set about creating private companies to build and operate infrastructure. In 1959, he established Dubai’s first telephone company; by 1961, it had rolled out an operational network. The city’s private water company established a regular supply of piped water by 1968.

By 1960, the city’s airport had opened, with flights operating across the Middle East. In 1963, the Sheikh opened the first bridge across Dubai Creek, paid for by tolls. The airport was expanded in 1965 to enable long-haul flights and was expanded again in 1970.

By the late 1960s, Dubai was also a hub for the global gold trade – much of which was based on the illegal sale of gold to India. In 1966, more gold was shipped from London to Dubai than almost anywhere in the world (only France and Switzerland took more).

And again, this is all before the discovery of oil. By the time that Dubai struck it rich in 1966, it was already a growing port, with a solid base of infrastructure and a low-tax, pro-business environment. Of course, the discovery of oil supercharged Sheikh Rashid’s vision.

“Roads, bridges, hospitals, and schools were constructed in a construction glut which propelled Dubai’s economy through the 1980s. As the old saying goes, build it and they will come”

But Sheikh Rashid had the foresight to know that one day, the oil would run out. He understood that one day, the city would need to survive without oil – and so set about making Dubai a world-leading hub for regional and international commerce.

In 1972, Port Rashid was constructed and in 1979, it was followed by the Port of Jebel Ali, today the busiest in the Middle East. In 1978, Sheikh Rashid opened the Dubai World Trade Centre. Dubai Creek was dredged and widened in the early 1970s. In 1983, Dubai Drydocks opened.

Meanwhile the city’s airport was expanded, and hotels were opened for business travellers. Roads, bridges, hospitals, and schools were constructed in a construction glut which propelled Dubai’s economy through the 1980s. As the old saying goes, build it and they will come.

This infrastructure-first approach was the foundational principle of Dubai’s pro-business policy environment. By leveraging the city’s geography and encouraging businesses to invest, Dubai made itself into one of the Middle East’s leading trade entrepôts.

The city sits at the mouth of the oil-rich Persian Gulf, with convenient maritime connections to Asia, Europe, and Africa. By air, more than 50% of the world’s population is 7 hours or less from Dubai – again, ideal geography for an international business hub.

“26 free trade zones, companies enjoy a 50-year corporation tax exemption, and no international tariffs. Many of these free trade zones use English common law”

However, it’s not just geography and infrastructure. Dubai has no income tax. Corporation tax is low at 9% – and in 26 free trade zones, companies enjoy a 50-year corporation tax exemption, and no international tariffs. Many of these free trade zones use English common law.

These zones create an extremely business-friendly environment – many international businesses have their regional or global HQs in Dubai. At the same time, the state invests in the infrastructure – roads, schools, hospitals – needed to keep business travellers coming.

And speaking of business travellers, Dubai – and the rest of the United Arab Emirates – is home to a large number of foreigners. In fact, 88% of the UAE’s population are expats. The territory’s tax-free status and world-leading infrastructure attracts high net-worth individuals.

However, unlike in Europe, immigrants in Dubai live under strict conditions. They do not benefit from state welfare and can be deported at any time. It is almost impossible to become a naturalised citizen. In return, migrants get to make far more money than they would at home.

This is particularly true for low-skilled migrants, often from South Asia, who come to the country under the so-called ‘kafala system’. Under the kafala system, all migrant workers need to have an Emirati sponsor – if their employment ends, so does their residence.

Which brings me onto the final aspect of Dubai’s success – law and order. The city has a zero-tolerance approach to crime and public disorder. The Dubai Police employs drones and has an average emergency response time of 2 minutes and 24 seconds, as of Q3 2023.

“Despite popular misconceptions, its rapid rise owes just as much to sensible policymaking as to oil. Not everybody can turn a patch of desert into a global megacity!”

Sheikh Rashid passed away in 1990. He was succeeded by his son, Maktoum, who ruled until 2006. In turn, Maktoum was succeeded by his brother Mohammed, who rules Dubai to this day. Though Dubai has grown considerably since Sheikh Rashid’s time, the basic principles are the same.

In many ways, the principles that built modern Dubai are the same as those that built Hong Kong, Singapore – or even, historically, London.

- Openness to business

- Ideal strategic positioning

- Shrewd investments in infrastructure

- Pragmatic governance

- Law and order

Whatever you think of Dubai, the city’s growth is one of the most incredible stories of the 20th century. Despite popular misconceptions, its rapid rise owes just as much to sensible policymaking as to oil. Not everybody can turn a patch of desert into a global megacity!

Yes, it really is true – as of today, less than 1% of Dubai’s GDP is generated by oil revenues. In fact, it’s commerce, financial services, real estate, and transportation that are the biggest drivers. The ultimate service economy!

Reproduced with kind permission of Sam Bidwell, Director of the Next Generation Centre at the Adam Smith Institute, Associate Fellow at the Henry Jackson Society, although views are his own. Sam can be found on X/Twitter, on Substack, and can be contacted at s.bidwell.gb@gmail.com. This article was originally published as a X/Twitter Thread at https://x.com/sam_bidwell/status/1827802745740337507