First published in February Mike Swadling writes about the Laffer Curve. It felt for a short while under Liz Trust and Kwasi Kwarteng as if the Conservatives had rediscovered the problem with high taxes, but alas no more. Once again, we are back in the situation described by Winston Churchill as “I contend that for a nation to try to tax itself into prosperity is like a man standing in a bucket and trying to lift himself up by the handle.”

“The curve shows that at a 0% tax rate no income is raised, similarly at a 100% tax rate no income is raised, as no one would work to pay all the earning to government. Somewhere in between is a tax rate that maximises revenue for government”

Johnny Leavesley the former Conservative Party treasurer party donor, in an article in the Telegraph asked of the Government “Have they never heard of the Laffer Curve?”. You have to wonder. Surely a Conservative government, a Conservative government would have heard of the Laffer Curve, but alas it appears not. This is a government that has increased corporation tax and is increasing National Insurance rates. Do they really believe this will raise more money?

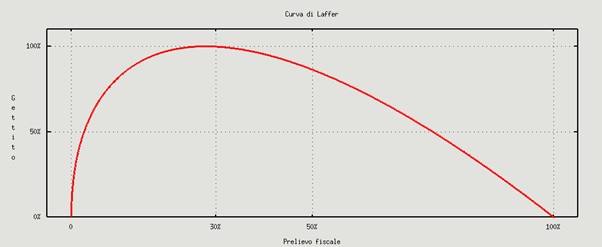

Whilst it is unlikely anyone reading Free Speech is unaware of the Laffer Curve it is maybe worth just noting what it is in case anyone from the government is reading. Named after Arthur Laffer, the Laffer Curve illustrates the relationship between the rate of taxation and the resulting government revenue. The curve shows that at a 0% tax rate no income is raised, similarly at a 100% tax rate no income is raised, as no one would work to pay all the earning to government. Somewhere in between is a tax rate that maximises revenue for government.

Separate to a moral case for keeping more of your own income, even if you believe in a high spending government, higher tax rates make no sense. People often assume the higher the tax rate, the higher the tax take but this is not the case. As a little thought experiment do you believe more income would be raised with an 80% tax rate or 20% tax rate? If you think of your own circumstances, it’s likely that at a 80% tax rate it would not be worth your while working in your current role. It is quite possible you would look for cash in hand work and you certainly wouldn’t be looking to take on more hours in a role taxing you at 80%. Whereas at a 20% tax rate is possibly less than you pay today. You might be tempted to work more hours or take on a more stressful but rewarding role knowing you get to keep more of your money.

“Strangely none of us could remember the Minister or the Senior Civil Servant coming in to help us with our work at the weekend, but somehow, they were always there to help us with the income for it.”

My own experience with the Laffer Curve came some years ago working with a team of engineers who were all approaching a new higher tax bracket. Much of our work involved weekend overtime and everyone’s hand would shoot up at first opportunity to work a lucrative Saturday. Then suddenly our incomes that year had breached the threshold, we noticed we were no longer taking home the lion share of our income for the weekend, instead it was split fairly evenly with government. Strangely none of us could remember the Minister or the Senior Civil Servant coming in to help us with our work at the weekend, but somehow, they were always there to help us with the income for it. From that point onwards finding someone to cover a weekend became increasingly difficult, and ‘bribery’ in the form of overtime no longer automatically worked.

The great mistake people often make is to forget that working itself is a cost, the cost is your free time, your energy, time not spent with your family or friends. This all has to be weighed up against the rewards you receive for working. This is equally true for businesses, setting up a business requires an investment of money and energy. Many people set up businesses in areas they’d already worked and where they could already draw decent income. When you take on the risk and extra effort of running your own business you need to see the extra reward. What feels like a small increase in corporation tax maybe the difference from someone starting their own enterprise, employing people, and creating value or staying in a role they have today and letting somebody else hold the risk.

Nevertheless, the government seems committed to the idea that raising tax rates will raise the revenue needed so recover from the economic armageddon of lockdown. Prior to the pandemic the UK government had been spending just over 39% of GDP, it shoots up to over 52% last year and is likely to remain over 40% for some years to come. What does the government know that we don’t, and why do they think increased tax rates will somehow help?

“The basic rate income has been as high as 35% and as low as 20%. The top rate has been as high as 83% and as ‘low’ as 40%. Yet the total tax take has never been lower than 32.5% of GDP and never exceeded 37.5% of GDP.”

Since the 1970s tax receipts have never exceed 38% of GDP, mostly that have hovered around 35%. In this time, we have had governments of Labour, Conservative, LibLab Pacts, Conservative Liberal coalitions, the UUP prop up James Callahan, and the DUP prop up Theresa May.

The basic rate income has been as high as 35% and as low as 20%. The top rate has been as high as 83% and as ‘low’ as 40%. Yet the total tax take has never been lower than 32.5% of GDP and never exceeded 37.5% of GDP.

Higher tax rates don’t increase tax revenue, something this government has clearly never heard of.

This article was first published in the Blacklist Press Free Speech newsletter.