The Coulsdon and Purley Debating Society planned to hold two debates in September but ran out of time on the night. One was planned on “A small income tax increase is justified to fund social care”.

The text below was originally written by Mike Swadling as a speech to be delivered to a live audience for the purpose of a debating society. Join them for their next debate on Monday 4th November, where the subject will be “It is unrealistic nowadays to have an unarmed police force”.

Other details from debate club nights can be found in CR5 Magazine.

“To use the dreadful term many people are bed blocking what is say a £500 a day bed, because a roughly £500 a month social care package can’t be provided”

Yes pay more

We are at the start of a 25 year period of peak age. The demographics mean for a generation we will have older people, often needing more care and fewer working age people to pay for it. This will eventually ease away, but this a challenge facing us now.

I suspect I am not alone in having seen a loved one in hospital, not able to leave for a lack of social care. To use the dreadful term many people are bed blocking what is say a £500 a day bed, because a roughly £500 a month social care package can’t be provided.

This doesn’t make sense for the patients’ mental or physical health, their family’s needs, costs to the NHS and taxpayers, or the needs of the person requiring that ‘blocked bed’.

That extra funding is needed few would doubt. The question is how do you provide it?

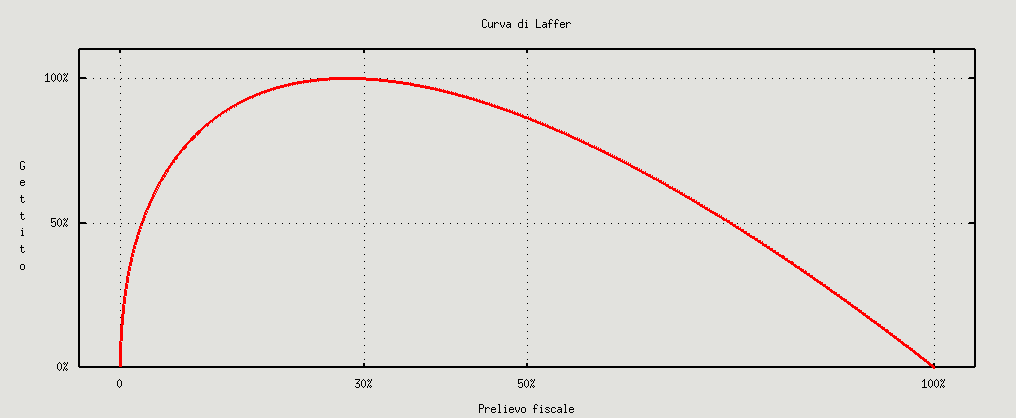

Laffer Curve

Let me try a little thought experiment with you.

Which do you think would raise more revenue for the government?

An income tax rate of 100% or 0%?

(Answer: both the same £0 why would anyone work to pay 100% tax)

Ok which rate do you think would raise more money for the government?

An income tax rate of 99% or 1%?

(Answer: 1% why would anyone work to pay 99% tax, we all work at a tax rate of more than 1% tax)

An income tax rate of 75% or 25%?

(Answer: 25% why would anyone work to pay 75% tax)

This demonstrates higher tax rates do not necessarily mean higher tax takes.

Known as the Laffer curve after the Economist Arthur Laffer. It predicts somewhere between 25% and 33% is the point where government income is maximised.

The disincentives in tax, do not outweigh the extra income from higher rates.

Broadly in income tax people are prepared to say two for me, and one for you. But no more.

“the total tax take has never been lower than 32.5% of GDP and never higher that 37.5% of GDP. Mostly these fluctuations are around the periods of recessions as the economy rapidly changes. Higher tax rates don’t increase tax revenue. People simply refuse to pay it”

Tax

On the UKs average income of about £30,000.

- you pay about £6,000 in tax and national insurance

- you are usually be responsible for let’s say half the average £1600 council tax

- about £200 in car tax

- you pay about another £200 in air tax for your holiday

- and close to many of our hearts, 52p on a pint and about £3.5 on a £7 bottle of wine.

It’s not hard to see about a third of our income going in tax.

Total government tax revenue as a percentage of GDP is about 36%, whereas spending is about 37%.

Since the 1970s tax receipts have never exceed 38% of GDP, mostly that have hovered around 35%

- In this time we have had governments of Labour, Conservative, LibLab Pacts, Conservative Liberal coalitions, the UUP prop up James Callahan, and the DUP prop up Theresa May.

- In that time basic rate income has been as high as 35% and as low as 20%.

- The top rate has been as high as 83% and as low as 40%.

- It’s not just income tax. Corporation tax has been as high as 52% and as low as 28%

Yet the total tax take has never been lower than 32.5% of GDP and never higher that 37.5% of GDP.

Mostly these fluctuations are around the periods of recessions as the economy rapidly changes.

Higher tax rates don’t increase tax revenue. People simply refuse to pay it.

They work less, more of off books, on in the case of the most highly skilled, simply move and work elsewhere to avoid overly burdensome tax rates.

High tax rates kill economic growth.

Savings

If you want to spend more on social care, find an existing poor use of money and reallocate it. You can also reduce the costs of providing the care itself. If I could ask your indulgence with a few suggestions:

- Merge responsibilities and budgets of the NHS and Social Service.

- As a result local managers can decide if the best service is provided by funding acute care or stopping bed blocking.

- As I have said I firmly believe many £500 a day beds are being filled for lack of a £500 a month care package.

- More money is pouring into the NHS. You might not think it’s enough, but every year spending increases. Form 3.7% of GDP in 1970 to 7.1% now, the trend is relentlessly up.

- Rather than focus on building more and better hospitals for a National Hospital Service, let’s focus on a National Health Service.

- Let’s see if there are more efficient ways to spend that money, that get better overall outcomes.

- Let’s get creative. Some people require a huge amount of care, but lots of fairly active able pensioners and others require a little bit of social care. At the same time we have problems caring for special needs adults and children and a high cost of nursery care.

- Let’s look at facilities where we can bring old and young together for both their benefits, and reduce the cost of staffing in the process.

- Experiments like those carried out by the ExtraCare Charitable Trust or St Monica Trust show such operations reduce depression and improve general health in the elderly whilst increasing maturity and language skills in the young.

- From 2013 all new Nurses need degrees. Why? Does it really require two years in college and 3 in University to empty a bed pan?

- Are straight A’s needed to provide a good bedside manor?

- Are these perhaps skills better learnt by doing, rather than by reading a book or sitting in a lecture theatre?

- Some functions performed by nurses may need additional qualifications but clearly not all. There is anecdotal evidence that Nurses with degrees are less focused on being a patient’s friend, providing basic comfort or even a clean environment and more on only the work requiring graduate studies.

- A mixed ward with graduate, on the job highly trained, and new less skilled nurses providing basic care, will be cheaper, and frankly might be better at providing the full spectrum of care needed for patients.

Achieving the same level of care at a cheaper rate per a patient, means more care can be provided, or more money for life saving drugs, or simply a lower charge for those families paying for care.

Summing up

As I have said I think we do need to put more funding into social care. But an income tax increase is simply the wrong way to provide it.

It may sound good, but it won’t do good. In fact it could have the opposite effect.

If you want more money to spend on social care, re balance government spending and make this a priority.

Vote against this motion, don’t reduce tax take and leave those most in need paying for a nice sounding, but wrong doing proposition.

Photo by The original uploader was Blakwolf at Italian Wikipedia. – Transferred from it.wikipedia to Commons., CC BY 2.5