Economic Piece by Josh L. Ascough

Consumer Goods and Capital Goods; these are terms the average individual has heard before. But how much is understood about these terms?

What qualifies as Capital? Are there different kinds of Capital? What counts as Consumer goods? Throughout this article I hope to give the reader an in depth analysis of these terms, their technical and theoretical purposes, how they relate to one another, and what their qualities are.

We will treat this as a process throughout the article; from capital to consumer; with a few interchanges to give context and further, detailed analysis.

Before delving into such areas, a mundane but important question must be posed and answered; What is Economics?

Economics is the social science, formulated around the study of human action towards ends with scarce means. Economics holds the epistemological (theory of knowledge) view of a priori knowledge (knowledge that is acquired independently of experience, and proceeds from theoretical deduction); that all human action is purposeful to the individual subject; whether his own deductions be rational or not, all of his actions are purposeful towards his goal or goals. This is where the subjectivism of Economics comes into play; particularly with the regards to the Austrian School.

The subjectivism of economics has gone through a process of clarification. During its early period, it was believed that the subjectivism of economics depended on the assumption of perfect knowledge; that all men at all times must be omniscient, in order to engage in economic activity. This position however, takes the view (intentional or not) that the market is in perfect equilibrium, and adjusts to perfect equilibrium relative to the circumstances, and regards all human decisions and values are fully determined; leaving no scope for the autonomy of the human mind. This leads to no room for the entrepreneur. Another view to which economics took about subjectivism, was that all economic activity and human decisions are spontaneous with no purpose and totally unexplainable; this view of the subjectivism of economics leaves us with no hope or ability for understanding market regularities, or human action as in terms of the subjects purpose.

This view of the subjectivism of economics was revolutionised by the late, Ludwig Von Mises. Mises recognised the autonomy of the human mind; the subjectivist freedom for human choice, which bear the imprint of the external circumstances. The external circumstances do not themselves constrain or determine action, but the actions of the autonomous man do take his circumstances into account, with regards to the knowledge he holds of the external. The Mises understanding of subjectivism in economics dismisses the notion of perfect knowledge, and the omniscience of man with regards to his value and action; instead, taking the view that at any moment, markets are pervaded by widespread ignorance on the part of the market participants; there is no such concept of perfect knowledge, nor perfect equilibrium. An additional and important feature of the subjectivism of economics, recognises that error on the part of market participants, and disequilibrium, creates opportunities for the existence of the entrepreneur, and entrepreneurial activity.

Before moving on to the main area of our subject, it is additionally important to explain what an economic good consists of.

Economic Goods require a few qualities to qualify as Economic Goods:

- Scarcity.

- Human Need.

- Belief of the Goods Ability to Satisfy Wants or Needs; Directly or Indirectly.

- Command or Claim of Ownership Over the Good.

Economic goods are split into two distinct groups:

- Good of Lower Order.

- Goods of Higher Order.

The value or price of all economic goods are subject to marginal utility.

What is Marginal Utility?

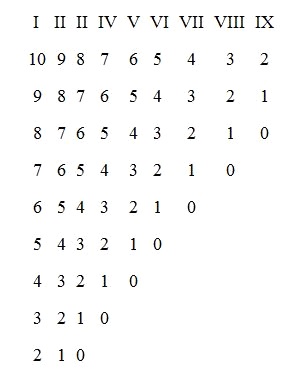

People’s wants are ranked in terms of the importance of their satisfaction. Let us use an example of a farmer. The farmer has 5 sacks of wheat, and his wants/needs are as follows:

- Bread For Living.

- Bread For Health.

- Seeds For Planting For Next Harvest.

- Feed Farm Animals. Cattle

- Produce Vodka.

- Feed Pets.

Our farmer in question would use the wheat to satisfy these wants. But how does he allocate them? What value does each sack of wheat hold? To answer this, we must ask: Which want or satisfaction would I do without if one of these sacks were lost?

For example let us assume a pack of foxes were to break into the barn where the sacks are located, and ate all of the wheat inside the 2nd sack. The want to do without is the 5th. The value of each sack is equal to the sack which satisfies the lowest-ranked want, to which the supply is capable of serving.

The level of satisfaction is utility. The lowest want is the Marginal. Hence value is equal to Marginal Utility.

Capital: What Is Capital?

Capital refers to economic goods of Higher Order. Higher Order goods are economic goods to which the satisfaction of human wants or needs is done so indirectly. These economic goods are not used for consumption or the direct satisfaction, but utilised to indirectly service wants or needs, and for further production. As a brief example for the moment, the car you drive to go to the supermarket is an economic good of higher order; or capital good. You do not consume the car itself, the car is utilised to indirectly satisfy a human want or need, with acquiring economic goods of lower order for consumption, or for acquiring other economic goods of higher order or capital, for further and better indirect satisfaction.

These are very broad brush terms though, as can be seen in the brief example of the car, a much more in depth explanation is required, as there are different kinds of capital; including different types of capital in terms of purpose.

There are two fundamental facts with regards to capital goods, which exhibits the complexity with regards to capital goods (economic goods of higher order).

Capital is Heterogeneous: All forms of capital are different and diverse; they’re not all the same. For example a beer barrel is not a boiler or a blast furnace.

However, stating this, each piece of capital is also Multi-Specific: Each piece of capital can be used in multiple lines of production.

Because each piece is different, they can’t substitute for each other perfectly, however, because they can go into different lines of production, they can substitute at different ratios for different things; the economic calculation for capital comes down to calculating the relative scarcity and alternatives; for this, you need a pricing system to signal the various marginal production costs and marginal values of consumers, in order to configure what lines of production to go into, and at what quantities.

In regards to the Capital and Interest, a standard terminology for capital is used.

The standard term is: Capital Goods – Produced Means of Production.

However, this conflates Capital with Capital Goods. The distinction between the two can be summarised as follows:

Capital Good: Reproducible Means of Production.

The reason such a distinction is important is due to the different functions between Capital and Capital Goods. The late Bohm-Bawark coined the term evenly rotating economy (ERE) when referring to this issue. In the ERE, Capital Goods earn gross rent, but do not earn net rent; as only the original factors of production (labour and natural resources) – earn a net rent within the ERE. The reason for Capital Goods not earning net rent is due to the fact that they are reproducible.

For simplicity sake:

Capital Goods = Physical Goods.

Capital = Financial Goods.

To sum up when not referring to Capital Goods, Capital is within reference to the total sum of money prices for assets related to an enterprise, minus any financial obligations.

To give a further explanation to this, let us imagine a laundry shop owner. If you were to ask the owner how much Capital Goods he has in his business, this would be referring to his physical goods; washing machines = Capital Goods, the till = Capital Goods, laundry detergent = Capital Goods etc.

If you were to turn to this same laundry shop owner (don’t ask him too many times otherwise he might get bored with all the questions), and ask him how much Capital is in his business, this would be referring to if the business was sold; all debts and loans paid off, how much money he, as the owner would hold.

“In the market economy capital accumulation is required for an increase in living standards, and to ensure a society is made wealthier”

In the market economy capital accumulation is required for an increase in living standards, and to ensure a society is made wealthier.

Capital accumulation requires the setting aside of money; in relation to their time preference, for future consumption by forgoing current consumption. This allows for further accumulation of tools, machinery, and reproducible means of production. The accumulation of capital plus saving for a preferred time frame of future consumption, allows for higher degrees of efficiency. This may seem bizarre since if there is an immediate need for consumption, and there is no time preference for future consumption, how can there be efficiency in waiting; it may be more easily conceived if we refer to it as relative time preference.

To give an example of this in action, let us imagine a man living on an island, and he has a need for water to have a bath. If this is an immediate need (maybe he has a hot date with the girl on the next island tomorrow), he will likely cup his hands to bring water to his home. If however this is not an immediate need and he holds time spare, he could climb up a tree, grab a coconut and break it to use the shell to more efficiently gather water.

I made a quick reference to interest and I will quickly go over two important questions:

- What are Interest Rates?

- How is Interest possible?

- Interest Rates are prices related to time preference for capital funds.

- Interest Rates signal to investors and entrepreneurs people’s willingness to postpone consumption; or their need to have consumption sooner, rather than later.

- Sooner Consumption = High Interest Rate. Future Consumption = Low Rates.

- Interest Rates regulate and allocate how much production is geared towards present consumption verses future consumption.

- Interest Rates coordinate the capital process. When consumers wish to save for the future (for college for example), they will cut back on current consumption; such as eating out at restaurants, visits to the cinema etc. It should not be misunderstood as being “current production is down = recession”; resources have been reallocated for a future time preference, towards savings for future consumption. This coordinates signals to investors and entrepreneurs that taking out loans is now more affordable

With regards to how interest is possible, we need to delve into another question:

What is the interest problem?

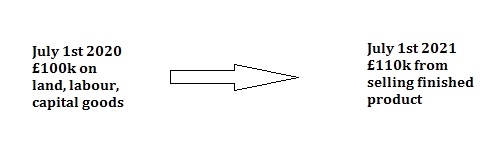

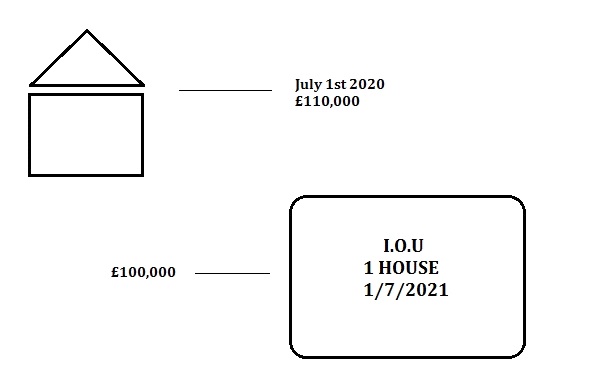

The interest problem, according to Bohm-Bawark is as follows:

“Suppose a Capitalist can spend £100,000 on land, labour and capital goods. One year later, the finished product can be sold for £110,000. How can this undervaluation of the factors persist?”

Anyone with financial capital in the present, who can put it to work and earn back not only the principle sum but money on top is referred to as an interest return. Why is it possible?

Before answering, it is important to mention what is known as, The Naive Productivity Theory. This is a term which was first mentioned in Bohm-Bawerk’s piece, Capital and Interest when critically referring to the Productivity Theory.

The Naive Productivity Theory notes that the return to capital goods (originary interest) is due to capital being productive.*

*Originary Interest is the ratio of the value assigned to want-satisfaction in the immediate future (current consumption) and the value assigned to want-satisfaction in periods of future consumption. It is present in market activity in the discount of future goods against present goods.

The Naive Productivity Theory however is incorrect. While it is true that capital goods are productive, and they would not be utilised were they not, this does not answer why interest is possible. If interest was possible because of The Naive Productivity Theory, then why wouldn’t entrepreneurs bid up the price of these capital goods; so instead of being able to buy capital goods for £100,000 and sell later for £110,000, they would be buying at £110,000 and selling for £110,000?

The way this is possible, is through Time Preference.

Present goods are preferred and hold a higher marginal value than future goods of comparable qualities, and need-want satisfactions.

Subjective Price Theory states that a pre-built house has a higher price than a contract for a house to be built in the future, because; ceteris paribus, consumers have more immediate wants to be satisfied.

Even if the person buying the contract at £100,000 for a house to be built and delivered in the future has no want for it, they recognise they can sell the house with a return to those on the market with more immediate wants.

I shall very briefly go over the subject of Consumption Goods.

Consumption: What Are Consumer Goods?

Consumer Goods refers to economic goods of lower order. Economic goods of lower order; or consumer goods, are goods to which the individual holds command over, that produce the satisfaction of human wants/needs directly and without further allocation of capital goods (economic goods of higher order).

Consumption goods; or goods of lower order, are the final products of the line of production which directly satisfy the want-needs and marginal values of the person who holds command over them.

Stating this however, not all consumer goods are for direct consumption. As a simple example; because I don’t want to spend too much time on consumption goods after so much time dedicated to capital/capital goods, let us take a handful of examples of what I mean by this:

- Houses.

- Printers.

- Refrigerators.

- Chicken.

Houses and chicken are an easy economic good to classify as consumer goods. Human beings need shelter and food, and so these consumer goods fulfil the purposes of direct consumption.

Printers on the other hand, can fall into two categories if they are not for the purposes of profit. On the one hand these are the final product after the coordination of capital goods (goods of higher order) and are purchased by consumers. However, saying this, they may also be used as capital goods from the perspective of the consumer. What I mean by this is that, nobody buys a printer for it to be the final product to which he will directly consume; people buy printers, in order to utilise them as personal capital goods, for the purposes of producing direct consumer goods; i.e. printing pictures, important documents, or receipts for consumer goods they’ve in addition purchased which are to either be directly consumed, or like the printer, be capital goods owned by said consumer to coordinate other goods he will directly consume.

“Now refrigerators are not only an extremely beneficial invention, but they’re also a great example of economics at work in the home; apart from financial capital, they can be used to represent consumption goods, capital goods, and interest/time preference, all at once within the home of the consumer”

The final example are refrigerators. Now refrigerators are not only an extremely beneficial invention, but they’re also a great example of economics at work in the home; apart from financial capital, they can be used to represent consumption goods, capital goods, and interest/time preference, all at once within the home of the consumer.

Refrigerators are consumer goods due to them being economic goods of lower order; the final outcome from the line of production and the allocation and coordination of capital goods. In addition they are capital goods for the consumer who owns the economic good in question, due to the fact they are not consumed themselves, but are utilised and can reproduce the activities they have been allocated to (keeping food fresh), to allow better satisfaction of direct needs-wants of the consumer. Finally, refrigerators represent interest/time preference in the home. Most of the time, people don’t buy 2 weeks’ worth of food for current consumption (unless they have a very big appetite). Refrigerators allow the consumer to save food for an allocated time period preferred for future consumption, for when they’re marginal utility will be higher.

There are many other areas to be talked about, particularly with regards to the division of labour, which links heavily to capital investment, allocation and coordination of capital goods and time preference, but I have taken much time over the subject we were focussed on; this may be an area to return to another time. For now I shall leave the reader with a passage from Ludwig Von Mises’s book, Planning For Freedom page 17-18, on the subject of economic organisation, economic coordination, and entrepreneurship.

“The truth is that the choice is not between a dead mechanism and a rigid automatism on the one hand and conscious planning on the other hand. The alternative is not plan or no plan. The question is: whose planning? Should each member of society plan for himself or should the paternal government alone plan for all? […] it is spontaneous action of each individual verses the exclusive action of the government.

Laissez faire does not mean: let soulless mechanical forces operate. It means: let individuals choose how they want to cooperate in the social division of labor and let them determine what the entrepreneurs should produce. […]”

Image: https://pixabay.com/illustrations/mark-marker-hand-write-516277/