Opinion Piece by Jeremy Wraith

Summary

1 Introduction

- The coronavirus pandemic has severely damaged the UK economy. However, this is also happening in every country in the world. This makes a fantastic opportunity for UK businesses to expand and export with the right encouragement from the government.

2 Brexit

- The most important factor in the UK recovery is to cancel the Withdrawal Agreement (WA) NOW and eliminate ALL aspects of EU control over the UK forthwith.

3 Trade

- The UK does NOT need a trade “deal” with the EU. This will not only inhibit future trade with the EU but more importantly, UK trade with the rest of the world (ROW).

- The UK government must invest in UK businesses, large and small, which have an export potential so that export opportunities can be grasped. This will cost a lot of money and suggestions are made to reduce UK waste and spending. In addition, the UK must develop and produce more products at home so that it does not rely so heavily on overseas supply chains.

4 UK Business

- 4.1 Cut UK corporation tax by 50%.

- 4.2 Cut business rates by 50%.

- 4.3 Stop all foreign (i.e. EU) fishing in UK waters and develop UK fishing industry.

- 4.4 Produce Fisheries Protection and Border Force vessels in UK shipyards.

- 4.5 Expedite Free Ports.

- 4.6 Expand UK armaments products.

- 4.7 Develop UK agriculture.

- 4.8 Education. Expand technical schools and colleges.

5 Paying for UK investment

- 5.1 Cancel the Withdrawal Agreement NOW.

- 5.2 Reform the House of Lords (HoL)

- 5.3 Scrap the BBC Licence fee.

- 5.4 Scrap VAT.

- 5.5 Cancel HS2 now.

- 5.6 Scrap global warming legislation and associated costs.

- 5.7 Actively develop fracking by UK companies

- 5.8 Reduce foreign aid. Use foreign aid money to develop and produce UK products which can be sent to and used by poorer countries.

- 5.9 Anyone, apart from a few exceptions, paid from any form of public funds to have a salary cap of £100,000.

6 Civil servants

- Introduce a scheme to enable taxpayers and council taxpayers to dismiss civil servants and council employees.

7 Quangos

- Cull vast numbers of quangos. Restore responsibility to Ministry and Ministers where it belongs.

8 Immigration

- All illegal immigration to be stopped IMMEDEATELY.

9 Nationalisation

- Railways and utilities to be nationalised. Royal Mail monopoly to deliver mail and parcels to be restored.

10 Multinationals

- Multi nationals to be effectively taxed on their UK earnings.

Suggestions to re-invigorate the UK economy

1 INTRODUCTION

The coronavirus pandemic and subsequent lockdowns has created financial, social and political crises in the UK where many companies are being forced to close down or dismiss staff. Hence, as the UK economy, which has also been in virtual lockdown, struggles to revive there will be a severe shortage of jobs, goods and facilities which people have come to expect.

However, this is also happening in most countries in the world as the pandemic is a worldwide problem. For example, nearly 33 million Americans were getting jobless benefits as of June 20, this year, about five times the peak during the Great Recession. This is a golden opportunity for UK businesses to expand and export goods and services around the world. Something which has been severely hampered over the last 50 years or so due to our membership of the EU.

It is an inescapable fact that when the UK joined the EEC in 1973 we had an approximately zero balance of trade, (BoT) with the EEC, i.e. we exported as much to the then EEC as we imported from them. On joining the EEC the UK’s trade, was brought under the direct control of the EEC/EU, (as were many other aspects of the UK economy) and has been ever since. As a result, the UK since 1973, has built up a staggering BoT deficit with the EEC/EU, currently costing us over £2 trillion. In fact, the UK, has not made a surplus in the trade of goods with the EU since the early 1980’s. This, despite the fact that the UK started the industrial revolution!

Hence, NOW is the time to re-vitalise the UK economy and regain our manufacturing and exporting base while the rest of the world is struggling to recover from the adverse economic effects of the pandemic. This is only possible with BREXIT looming and the UK supposedly gaining its complete independence from the EU’s stifling and grasping clutches. Some suggestions are made below to help the UK re-gain its former place as a world leading exporting nation.

“The question must be asked as to WHY do we need a “Withdrawal Agreement” at all? We are leaving the EU and that is surely a simple fact of life. The attempts to make a trade deal as part of leaving simply clouds the issue”

2 BREXIT

The foremost and most obvious start is to accomplish a meaningful BREXIT is to break completely free of any and all EU influence over our sovereignty and economy. The single example given above illustrates quite comprehensively the effect of the EU’s involvement in our economy. They have one aim and that is to make the UK pay through the nose to their advantage. See also my note;

The UK must abolish the Withdrawal Agreement and stop trying to agree a trade deal with the EU. At present the EU is insisting that we “leave” the EU on its terms only, i.e. with demands for the continuation of fishing rights and level playing fields etc. These demands are totally unacceptable for a sovereign, independent country that the UK aspires to be.

The question must be asked as to WHY do we need a “Withdrawal Agreement” at all? We are leaving the EU and that is surely a simple fact of life. The attempts to make a trade deal as part of leaving simply clouds the issue and is not necessary as discussed below.

3 TRADE

In 2019 the USA exported $336.6 billion worth of goods to the EU and imported $515.2 billion worth of goods from the EU. The USA and many of the EU’s other trading partners do not have a trade deal with the EU. All this trade is carried out on WTO rules.

In 2019 the UK exports to the EU amounted to £300 billion, but imports from the EU were £372 billion.

There is no reason to suppose that our trade with the EU will drop significantly after Brexit using WTO rules. Apart, that is from the EU’s insistence that we comply with their rules and regulations. They have even been threatening to deny the UK access to their single market and to deny the UK’s service sector from access as well. The EU cannot get over losing its ability to screw the UK unmercifully as it has done ever since we joined in 1973. See my note in the link above.

The UK says that it would like a “Canada Style” trade deal with the EU. However, we must beware of ANY deal with the EU as Canada has found, see last para of the note in the link above!

The facts are that:

THE UK DOES NOT NEED A TRADE “DEAL” WITH THE EU TO TRADE WITH THE EU!

THE UK DOES NOT WANT A TRADE “DEAL” WITH THE EU TO TRADE WITH THE EU!

This will avoid paying the EU £39 billion for the privilege of making a trade deal with the EU on their terms and which severely penalises the UK’s ability to export to them AND the rest of the world! In order to capitalise on the huge world wide opportunities post Brexit the UK must invest in and promote and expand its manufacturing and service industries now! This takes money and some suggestions are given below on how this could be done.

“Every UK Embassy and High Commission must have a Trade Commissioner whose sole role is to promote UK exports. Their performance can be measured and where this is not satisfactory they must be replaced”

4 UK BUSINESS

After Brexit the following actions should be done:

4.1 Cut Corporation Tax by 50%.

This should encourage large companies to stay in the UK, keep British workers in jobs and export from the UK. It will also help companies to improve their operating procedures and invest in new products.

4.2 Cut Business Rates by 50%

At the start of 2019 there were nearly 5.9 million small businesses, approximately 99.9% of the business population. They employed 16.6 million people, 60% of the work force, with a turnover of £2.2 trillion.

SME’s are vital to the UK economy and must be encouraged. Ways of doing this are discussed below.

NB Neither of the above would be possible under the EU’s demand for a “level playing field”.

4.3 UK Trade Commissioners

Every UK Embassy and High Commission must have a Trade Commissioner whose sole role is to promote UK exports. Their performance can be measured and where this is not satisfactory they must be replaced.

4.4 Fishing

It must be remembered that UK paid the EEC/EU to take over UK territorial waters as an EU asset by Ted Heath when we joined the EEC in 1973. Since then the UK fishing fleet has been decimated and the loss of UK fishing rights in UK territorial waters must have cost our economy a total of over £100 billion.

The UK must therefore prevent any foreign fishing in UK territorial waters to enable the UK fishing industry to recover to its pre-EU levels. Once the UK fishing industry has recovered that will be the time to negotiate contracts for foreign fishing fleets to operate in UK waters, subject to strictly enforced quotas. This may take a few years to accomplish.

If, in the meantime, the EU carries out its vindictive threat to prevent fish imports from the UK then the markets in the ROW must be exploited. UK Trade Commissioners (see above) should assist in this activity.

4.5 Fisheries Protection and Border Force vessels.

UK shipyards must be used to expand our fleet of fisheries protection and border force vessels. These must be armed and capable of carrying Royal Marines for the need to inspect foreign vessels and their catches. This is an urgent need of the highest priority and until more new vessels are produced other vessels must be acquired and converted as necessary.

4.6 Free ports

The introduction of free ports must be expedited as this would be helpful to UK businesses.

4.7 Develop UK Agriculture

The UK must invest more in UK agriculture to limit food imports. In future, more imports should come from third world countries to help them develop.

4.8 Education

Develop technical schools and colleges. Abolish Tony Blairs ridiculous aim to send 50% of school leavers to university.

Train more UK doctors and nurses and abolish tuition fees at universities for much needed UK science, engineering, medical and technology students. Ensure foreign students pay their tuition fees at the start of each academic year or be denied access.

“Apart from being an almighty scam the UK contributes a vastly unimportant 1% of the worlds output of CO2. The commitment by Theresa May to make the UK carbon free by 2050 is monumentally stupid and must be repealed at the first opportunity”

5 PAYING FOR UK INVESTMENT

Encouraging UK businesses, cutting their costs and taxes will cost the government, and the taxpayers a lot of money. The government is already heavily in debt due to its necessary help to companies due to the coronavirus pandemic.

However, there are a number of ways that more money can be generated for UK investment in businesses and jobs as follows.

5.1 The Withdrawal Agreement (WA).

This must be cancelled forthwith. We must stop negotiating with the EU for a trade agreement. The EU has demonstrated time and time again that it is an avaricious, spiteful, and mean entity which loathes Britain. This, despite all the money,(£300+ billion) that the UK has contributed to EU budgets since we joined. Most EU countries have, by contrast, contributed NOTHING as they have been net beneficiaries for their total membership.

The UK must leave the EU and trade with them on WTO terms. This will limit their ability to limit the UK’s access to their markets. Something they continually threaten to do. This is something that they could and would do as part of the WA which was initially negotiated (i.e. allegedly “accepted”) by Theresa May. The Centre for Brexit Policy has apparently calculated that the WA would cost the UK £165 billion. We must prosecute Theresa May, Ollie Robbins and all their staff for alleged treason to show we mean business.

5.2 Reform the House of Lords (HoL)

The HoL is currently not fit for purpose and never has been (with a few notable exceptions) since the introduction of Life Peers. All 700+ of them must be abolished forthwith and the HoL reformed to consist of non-party members who should act as an independent checker on the House of Commons (HoC). This should save UK taxpayers about £20 million/annum.

See my note:

NB It is inconceivable that the Conservative, Labour or Lib Dem parties will accept reforming the HoL. After all, it is a haven for them to join after they retire and a means to reward their cronies, paymasters and to bribe prominent and influential people to agree to their policies and give their parties large funds. In the HoL they can get over £300/day of taxpayer’s money simply by signing in. Not to mention the taxpayer subsidised meals and vintage champagne!

5.3 BBC Licence Fee

This must be abolished by the end of this year saving all households from legally having to pay £157/annum to the BBC so they can watch ITV, Sky and other channels. The BBC has allegedly been promoting the EU since 1972 when Ted Heath and the Conservative government got them to allegedly support the UK’s entry into the EEC. Those people who support the BBC and its alleged anti-UK bilious propaganda can pay for it by subscription.

5.4 VAT

VAT is an EU imposed tax. Abolishing it will save SME’s a considerable headache in their accounting procedures. The taxpayers will save on the extra costs involved as these hit the lowest paid the hardest. Dismissing all the civil servants involved in its collection and administration will also benefit all taxpayers.

We already have an efficient tax collecting system in the HMRC. Loss of VAT income will be partly offset by savings in civil service pay and pensions for collecting it. Abolishing the VAT income can be compensated by increased taxation. This will shift the burden from the poorest people onto those more able to pay.

5.5 HS2

Must be cancelled forthwith. This is again an EU imposed liability which will not benefit the vast majority of UK taxpayers one iota. Scrap it NOW!

5.6 Global Warming

This is another burden on the UK taxpayer. The vast costs involved must be re-assessed and cancelled. Apart from being an almighty scam the UK contributes a vastly unimportant 1% of the worlds output of CO2. The commitment by Theresa May to make the UK carbon free by 2050 is monumentally stupid and must be repealed at the first opportunity.

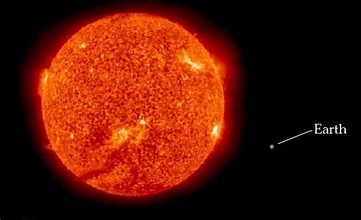

There is no doubt that man made global warming is a monumental scam. Firstly, look at the relative size of the earth compared to the sun!

Can anyone really believe that man can have more influence on the suns effect on earths atmospheric temperature than the sun has?

Secondly, it has recently been proved that the Mediterranean Sea was 3.6 ˚/F hotter during the Roman Empire than it is today. No doubt the climate change bigots will claim it was due to the Romans excessive use of coal fired power stations and drag races along the Appian Way in their Ferraris and Alfa Romeos!

5.6.1 The use of more wind farms must be halted. They are inefficient and ways of abolishing subsidising their cost of generating electricity must be investigated and implemented. (Apparently, they are compensated during shut downs due to high winds. Can you imagine the mentality of government officials agreeing contracts for the supply of electricity with provision for compensation payment when they cannot produce the goods?)

5.6.2 Coal powered generating stations are relatively cheap and reliable. The UK coal industry must be revived as much as possible as this is a UK asset.

5.6.3 The development of Small Modular Reactors (SMR’s) by Rolls Royce must be highly encouraged and implemented in the UK and for export.

5.6.4 The impossible law to make the UK net carbon free by 2050, introduced by Theresa May, must be repealed immediately.

5.6.5 The UK’s reliance on foreign firms to provide our electricity is a disgraceful indictment of our politicians. Years ago the UK was a world leader in nuclear power generation. Now the UK is dependent on foreign providers for our nuclear power stations. This is totally unacceptable. Some years ago Nicholas Sarkozy, then Premier of France, said that he did not want French consumers to pay more for their electricity bills. So, EDF allegedly added 10% to their UK customers instead!

5.7 Fracking

Fracking must be developed as fast as possible. This will provide cheap fuel for UK industry and it is a valuable UK asset.

5.8 Foreign Aid

The ridiculous legal commitment to give away 0.7% of our gross national income in foreign aid must be reformed immediately. For example, we continually see adverts on TV showing people having to spend hours each day collecting water. Part of the foreign aid budget should be invested in British industry and the products, such as water pipes, taps etc., given to poorer countries to improve their conditions. The farce of giving taxpayers money to richer countries like China and India is ludicrous. The Civil servants involved should be dismissed for incompetence!

In addition, the UK is one of only 6 countries that actually complies with the UN requirement. Repeal the law now and reduce our payments.

The remainder of the annual foreign aid budget should be invested in re-paying our enormous government debt. This can be drawn out in the event of natural disasters, such as typhoons, earthquakes etc. In these events ALL commonwealth countries should be helped as necessary. The interest saved on these debt payments will help reduce the governments annual deficit.

5.9 Salaries

The government should bring in a law making it illegal for anyone being paid from public funds being paid more than £100,000/year. Examples are:

5.9.1 50,137 NHS staff on £100,000 or more. Tax Payers Alliance (TPA)

5.9.2 The TaxPayers’ Alliance Town Hall Rich List identified at least 2,314 council employees in England and Wales with total remuneration deals of £100,000 a year or more in 2015-16.

The councils are making mugs of their council tax payers.

5.9.3 The BBC pays just 14 presenters a total of £11,715,000. Equivalent to over 7,500 licence fees.

The BBC is making mugs of their licence fee payers.

(NB The BBC has been found to be breaking its obligation to be impartial under the law and its Royal Charter on numerous occasions. This is allegedly especially true of its promotion of the EU since 1972. Hence, BBC personnel, including its governors, must all be prosecuted for allegedly fraudulently misusing license fee money, extorted from the British public, under the ultimate threat of imprisonment.)

5.9.4 Judicial salaries are eye watering. Just 4 members in grade 1.1 are paid a total of nearly £1 million. This includes the president of the supreme court which proved to be politically involved in denying the government the right to prorogue parliament. The Supreme Court must be abolished.

6 Civil Servants

It is a catastrophic failure of our society that enables us to hire and fire politicians every so often but prevents us having any control whatsoever over civil servants and council employees.

Sir Mark Sedwill is a good example. Formerly a diplomat he was apparently a trusted adviser to Theresa May when she was Prime Minister. In his top position which included being Cabinet Secretary, he was paid a salary of £205,000 and incurred expenses of £175,000 in just one year. When he stepped down he was awarded a payout of £238,000. WHY? This is totally unacceptable.

UK taxpayers paid his salary, his payout and his pension. We, taxpayers are his employers, yet we have absolutely NO input into his salary, payout or pension. This is not right and there should be a system whereby civil servants can be sacked by public demand where there is evidence of incompetence or wrong doing. For example, failures by public servants should be investigated, by an independent tribunal, the facts published and voted on by taxpayers. They should have a say in the civil servants continued employment and their pension rights. In the case of civil servants 100,000 signatories would be required to dismiss a civil servant for incompetence. This could be overturned by say 200,000 signatories. More are required as they will be committing others to carry on paying for the civil servant involved.

In the case of council employees the numbers would need to be reduced to say, 25,000 and 50,000 respectively.

The advantage of this sort of system is that civil servants and council employees would be continually reminded that they are our servants and NOT our masters!

7 Quangos

7.1 There must be a positive and effective wholesale cull of quangos. Why is it necessary to have a quango when we have a government department and a minister responsible for that function? Quangos are simply a device to divert blame for gross errors of management from ministers and ministries to external bodies!

7.2 The NHS is a good example. There are numerous health quangos tied up in Public Health England, (PHE). Its performance in dealing with this pandemic has been abysmal and yet the government is often blamed for the failures in providing PPE and ventilators etc.

7.3 PHE, which cost taxpayers £15 billion last year, once abolished its functions should be returned to where they belong. In the appropriate government ministries where taxpayers have the right to hire and fire politicians and where they should have the right to fire incompetent civil servants.

7.4 The use of agencies such as Serco, who have been contracted to spend £billions on housing immigrants stinks. Serco has a board of directors and shareholders who are all being financed by taxpayers. Their work should firstly be eliminated by completely stopping illegal immigration and limiting benefits to immigrants generally. This should all be carried out by civil servants whose bosses pay is limited to less than £100,000/annum.

7.5 Councils should be made to carry out public services by council employees. It is again ridiculous that private companies are contracted to do the work of rubbish collections and so on at a profit. If councils fail to carry out the services properly and at a viable cost then the residents should have the opportunity of sacking incompetent council officials.

8 Immigration

ALL illegal immigration must be stopped, and illegal immigrants deported whenever possible. It is ludicrous to keep accepting boat loads of people from across the channel, keeping them here, paying for their welfare etc. This is especially true now that an immigration points system is being started on Jan 1st 2021. All boat people from then on are thereby bucking the system, but we should start stopping them now! It is insane that we apparently have about 48,000 illegal immigrants many of whom are housed in 4 star hotels, costing UK taxpayers £2 to £4 billion/year. (Reported by Nigel Farage)

Regrettably, the PM’s offer to accept 3 million BNO holders from Hong Kong is probably not tenable at this time. Where are they going to be housed, their children schooled and so on? Potential BNO immigrants should be subject to the points system as for everyone else.

9 Nationalisation

The government should nationalise certain industries, many of which have been taken over by EU companies as part of the EU’s “more competition” policy for taking over British industry.

The list of companies to be nationalised are as follows:

9.1.1 The railways. Network Rails debt from government borrowing is already well over £50 billion. Nationalising the whole rail network would facilitate nationwide improvements in rolling stock and improving freight. In future, all railway manufacturing and servicing must be carried out by British companies using British steel and resources.

9.1.2 Network rail has 45 managers with annual salaries ranging from £142,000 to £250,000 yet the company owes the UK taxpayers over £50 billion!

9.2 Water is a free natural resource and is getting into short supply due to population increases. It is intolerable that consumers are having to pay for large profits to water companies some of which are based overseas.

9.3 Electricity supply should be nationalised. We have a national grid and should have a national supplier. Electricity supply charges can then be reduced nationally. This will assist household consumers and businesses as well. This will help to reduce their costs and making their products cheaper and more attractive worldwide.

9.4 Gas supply should be nationalised as for electrical supplies above.

9.5 Royal Mail’s monopoly to deliver mail must be returned. This was opened to foreign, (EU) competition, as part of the EU’s campaign to provide more competition and take over British industry.

10 Multinationals

It is obscene that multinationals such as Amazon, Google, Facebook etc., can apparently avoid paying tax in the UK by, for example, transferring funds to subsidiary companies abroad. The UK taxpayers are therefore losing £billions annually as a result.

All companies therefore must be made to pay a tax in the UK on money that is made on their business in the UK. This can be done by making it compulsory to pay a tax based on the higher of their total earnings or their profits.

11 Capital Punishment

The government should hold a referendum on re-introducing Capital Punishment for murder especially where DNA evidence has made the identification of murder suspects indisputable It is ridiculous that we spend a fortune jailing terrorists and other criminals who murder police officers etc. and then release them onto the streets after a few years.

Main image © Acabashi; Creative Commons CC-BY-SA 4.0; Source: Wikimedia Commons