Economic Piece by Josh L. Ascough

– This article is part of a larger collection of my work I hope to have available soon titled ‘The Social Science Of The Market’. – Josh L. Ascough

Many economagicians, central planners and establishment economists have an unnatural admiration for this leviathan juggernaut of pestilence; ignoring the fact that, many economic issues causing harm to individuals and societies are due to this abomination’s existence. The creation of this legally monopolistic, monolithic, malicious institution has been at the very heart of the decreasing value and standards of life.

In order to adequately talk about the central bank, we require delving into a few topics first, in order to fully understand the issue. These topics include:

- Deflation

- The Gold Standard

- Sound Money to Fiat Money

- Inflation

- The Boom/Bust Cycle

We will begin the subject with The Gold Standard and the process of Sound Money to Fiat Money.

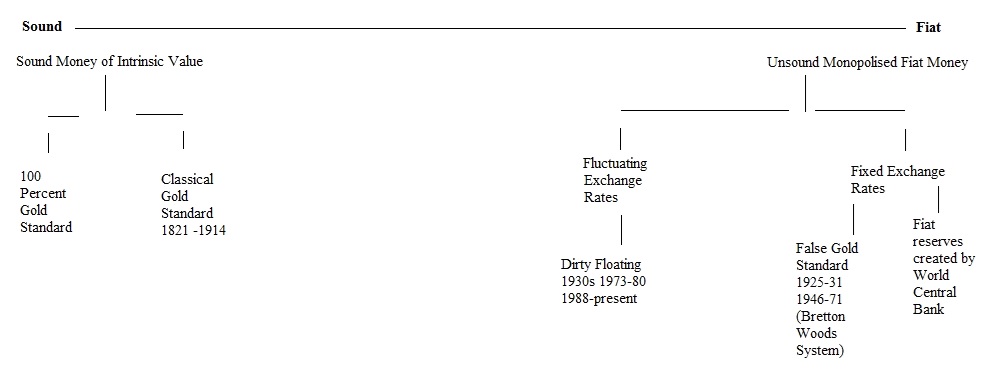

Let us first take a look at the spectrum of international monetary systems to gain a quick grasp of the subject.

The graph shown above displays a quick overview of The Gold Standards history, starting with its 100 percent Gold system, where there was no central bank or any format of paper money receipts.

“The Classical Gold Standard had the monetary unit set, to be legally defined as a weight of gold, and though it is a popular belief, the gold standard was not a creation of government, but a market supplied commodity with an intrinsic value predicated in use and exchangeability”

The Classical Gold Standard took place from 1821 to 1914. Under this system we had the creation of paper money receipts; these were not forms of money but were tickets or claims to the noted amount of weight in gold (a £20 note was not money, but a claim to 20 pounds of gold, which the bearer of the note could give to the bank to withdraw said amount of gold, or could use as a money substitute to purchase goods and services; the money substitute or ticket, could then be used by the new owner to claim 20 pounds of gold. The Classical Gold Standard had the monetary unit set, to be legally defined as a weight of gold, and though it is a popular belief, the gold standard was not a creation of government, but a market supplied commodity with an intrinsic value predicated in use and exchangeability, which developed over time as people found more reliability with the precious metal.

As a monetary unit, under the gold standard the currency name was not an indicator of national sovereignty, but was simply unit of gold measured in weight.

For example from 1834-1933, the US Dollar was legally defined as $1 = 1/20th of 1 oz of gold (23.22 grains), and the British Pound from 1821-1931 was defined as £1 = 1/4 of 1 oz of gold (113 grains).

With regards to the exchange rate of the gold standard, the gold standard was not a fixed exchange rate system, as all countries operated with the same form of currency; that being gold.

“the “exchange rate” of Dollars to Pounds for 100 years was $4.86 ÷ £ = 113 grains of gold, as there was a smaller weight of gold in the Dollar coins as opposed to the weight of gold in Pound coins. The exchange rate of the gold standard was simply a law of arithmetic”

So the “exchange rate” of Dollars to Pounds for 100 years was $4.86 ÷ £ = 113 grains of gold, as there was a smaller weight of gold in the Dollar coins as opposed to the weight of gold in Pound coins. The exchange rate of the gold standard was simply a law of arithmetic.

The operation of gold as the currency did not require or involve the fixing of the price. If an individual sought to redeem £4 for an ounce of gold, the bank or the government was not in fact selling gold to the bearer, but was simply fulfilling its contract to redeem the value of £4 to the title holder of the property. Another way of looking at this system and transaction, would be to think of placing a piece of property into a storage building and being given a receipt; the piece of paper is not the property object itself, but is a claim to the property and its rate of value is equal to the property.

Under the gold standard the MS (money supply) was strictly limited to the amount of gold in circulation and to that of gold mining; hence bank notes and deposits can only increase if and when new gold was to enter the banks. This is often referred to as “The Golden Handcuffs”, as the banks were restricted in how much money substitutes they could supply.

As a result of this, prices tended to fall over periods of time, as saving, investment and technological improvements increased the supply of goods and services available more rapidly than the increase of the money supply. Price deflations are natural outcomes of a gold standard. As an example in the US from the period of 1880-1896, price percentage decreased an equal amount of 30%, while GDP percentage saw an increase of 85%. A more broken down format would be a decrease of 1.7% per year, and an increase of 5% per year. This type of increase in production with a decrease in prices is what is known as “Growth Deflation”.

The destruction of the gold standard began during the period of WWI, when gold reserves in the US were centralised in to the Federal Reserve; prior to this, private banks held their own reserves of gold against the money receipts they issued. This was aided and achieved through the act of a heavy tax implemented on to all private issues of bank notes, alongside the exporting of gold being prohibited in 1917.

During the period of the 1920s, the private issuing of bank notes became outlawed. This was followed by the Federal Reserve cutting reserve requirements from 21.1% to 9.8%, which in turn caused the money supply to double from 1913 to 1919.

These first steps were achieved through mass propaganda by the government and the central bank, classifying the use of gold as “old fashioned”, in an attempt to have the dollar not associated with a weight in gold, but with a government owned paper money.

From 1922 to 1933, the Federal Reserve expanded bank reserves in an attempt to stabilise prices and assist Great Britain in returning to the gold standard, as a means of having foreign nations buy up the US gold supply.

In 1929 the Great Depression and the bank runs began, signalling the end of the classical gold standard, as Franklin D Roosevelt, on the 1st of May 1933 issued an Executive Order, prohibiting the ownership of gold by private citizens and businesses, with a criminal charge of $10,000 or 10 years in prison for non-compliance.

There was a temporary period where an apparent “gold standard” made a comeback, named the Bretton Woods System, from the period of 1946 to 1971.

However, the BW system was a faux gold system, and was an attempt to bring order to the chaos brought about by the newly adapted national fiat money systems, by covering it as a gold standard.

Under the Bretton Woods system, the US dollar was treated as the key currency; or the world reserve currency, and was made convertible into gold at a fixed rate of $35 per oz. This caused a devaluing of gold from the legitimate rate of $20 per oz.

All other forms of currency were convertible into dollars, but at fixed exchange rates, and currencies were only convertible into gold for central banks and governments; US citizens were not permitted to convert their dollars to gold or own gold, due to the FDR Executive Order of 1933.

The operations of the BW system were so that, currencies of foreign nations were expanded and placed into a pyramid on top of the US dollar, causing the Balance of Payments adjustment mechanism, which limited inflation under the gold standard to be null and void.

This lead to the Federal Reserve having the ability to create money, causing domestic inflation and BOP (Balance of Payment*) deficits without consequence, due to foreign governments and central banks buying up dollars with their own currencies instead of demanding gold.

Because of this, the Bretton Woods system caused a persistent BOP deficit due to a global surplus of the dollar. However, as long as foreign governments and central banks were willing to accept and hold excess dollars, the US did not require concern for the deficit; in essence, the US exported paper money and inflation to the world in exchange for economic goods.

On the 15th August 1971, President Nixon placed the final nail in the coffin of the gold standard, by renouncing the obligation of the US to convert dollars for gold, as decreed under the terms of the Bretton Woods system.

Under the current operation of fiat currency, gold would play no direct role under the fiat money system. The US dollar and other currencies continue as pure fiat money, which are unconvertable to gold. The monetary basis would be comprised of fiat paper money (government controlled central bank notes), which are held by the public and the banks within the vaults and cash machines. Thus, the central banks would continue to control the monetary system, by buying or selling bonds, and giving government’s political control over the supply and dealings of money.

*The Balance of Payments was an automatic mechanism, which would cease the increase in the money supply before it could cause too much damage to the economy. Under the BOP mechanism, if the domestic money supply increases, domestic prices would rise above world prices. This would lead to exports to the country in question decreasing and imports increasing; resulting in a balance of payments deficit. This mechanism maintained an equilibrium in BOP, and distributed gold throughout areas according to the demands for money (gold). In addition, the BOP operated inter-regionally, with the end result of a limited money supply increase and inflation by central banks. The mechanism operated as such: As the MS (money supply) increases, the domestic P (price) increases above world P. This causes exports to decrease and imports to increase, creating a BOP < 0. This leads to gold supply to decrease, creating a downturn in the MS, causing domestic P to drop below world P, and leading to exports to rise as imports drop, equaling a BOP > 0.

With the subject of the gold standard and the introduction of the fiat money system concluded, let us move on to the subject of Deflation.

Does the reader enjoy falling prices for consumers? Does the reader believe falling prices are good for the economy?

If the answer to both questions is yes, then there is not much purpose in continuing on with the subject of deflation; for the purposes of reaching the end result of the central bank subject however, I will continue.

Deflation is a natural occurrence of the market economy, and is generally subject to the same laws of supply and demand. Like any price for economic goods, the value of money is determined by the equilibrium level in relation to supply and demand.

An increase in the value of a money, or a reduction in prices is caused by a reduction of the money supply, or a rise in the demand for a money. We increase the demand for money when:

- A) We produce and sell more goods.

- B) When we aim to hold more of our money, leading to spending and investment to decrease.

It should be noted, that there are three kinds of deflation:

- Growth Deflation.

- Cash-Building Deflation.

- Confiscatory Deflation.

Growth Deflation is caused by the production and supply of economic goods seeing an increase; this is an economic growth.

A rapid increase in economic growth is caused by an increase in the investment of capital goods, which reduce the cost of production and increase profits. The newly increased supply of economic goods creates greater degrees of competition for money by sellers, and as a result increases the exchange value of money. If the money supply is allowed to increase very slowly alongside the fast increase in production, this will result in the value of money to increase, causing this to be reflected in falling prices.

Cash-Building Deflation is caused by economising individuals wishing to hold on to more of their incomes in relation to prices; prices can refer to consumer goods or rates for investment. The lack of spending causes the same result; demand for money to increase and prices to decrease.

Confiscatory Deflation is caused by the government confiscating money from individuals, demonetising notes or limiting the withdrawal amount of cash from banks. This form of deflation however is not a natural market occurrence, as it infringes on property rights and distorts the economy by sending false signals of economic activity.

“In 2001 Botox treatment was priced at $365; in 2013 the price was set between $99 -$149.

Liposuction in 1992 was at a cost of $1,600, and in 2013 the cost was roughly $999.”

Historical examples of Deflation can be examined with computers, HDTV’s, laser eye surgery and cosmetic surgery.

- In the 1970s mainframe computers cost upwards of $4 million; today, thanks to growth deflation, home computers are 20x faster, and are able to hold more memory; selling for less than $500.

- From 1980 to 1999, computer prices fell by 90% as the industry grew.

- In 2004, roughly 32 million TVs sold in North America at an average cost of $400, sized at 27 inches.

- In 2015, around 44 million TV’s sold in North America at a price of $460 sized at 38 inches.

- This shows that price per inch fell to $12.10, from a rate of $14.81.

- A broader breakdown of the overall price can be seen as such:

- 1990 ~ $36,000. 2003 ~ $3,000 – $5,000. Today ~ <$500.

- From the period of 1998, Lasik Eye Surgery was priced at roughly $4000 per eye. From 2013, the price was set around $300 per eye.

- In 2001 Botox treatment was priced at $365; in 2013 the price was set between $99 -$149.

- Liposuction in 1992 was at a cost of $1,600, and in 2013 the cost was roughly $999.

To add more detail to Cash-Building Deflation otherwise known as “Speculative Deflation”.

Cash-Building Deflation plays an important role, particularly during a recession, as businesses increase their cash holdings due to the production costs, such as wages and additional forms of input; capital, land, materials or machines, have seen a sharp increase during an inflationary period (or boom), which in turn have wiped out profit margins. This is a speculation of prices; the speculators have concluded that costs will fall and so seek to hold on to their resources until prices fall back to normal, or equilibrium levels.

This also accounts for entrepreneurs. The entrepreneur will hold on to his money supply and wait until wages and other input costs adjust to a reduced rate before they begin to proceed with investment.

Deflation plays a vital role in the speed of the readjustment period from a recession; we will go into the subject of recessions, booms and busts later in this section.

With all this said however; many commentators, financial writers and economists hold an irrational fear of deflation and the results of it, that being; falling prices. A handful of fear driven titles of blog posts and articles include:

- “The Deflation Monster Still Lives”

- “Why We Should Fear Deflation”

- “Defeating Deflation”

- “The Spector of Deflation”

In a congressional testimony, Alan Greenspan (2003) made the statement that a further drop in inflation would be “an unwelcome development.”

Further stating; “We see no credible possibility that we will at any point, run out of monetary ammunition to address problems of deflation.”

In 2002, Ben Bernanke gave a speech, in which he stated:

“The Chance of significant deflation in the US in the foreseeable future is extremely small. The Fed would take whatever means necessary to prevent significant deflation that might occur would be both mild and brief.”

This fearmongering should be seen for what it is; a desire to promote an irrational fear of deflation among the public, in order to justify further inflationary policies; the subject of inflation we will delve into in the following.

Inflation could be misleadingly seen as simply an increase in prices. This, however, is an errored concept. The price of an economic good can rise and fall for a variety of reasons: if the overall consumer demand for an economic good sees an increase, then the price mechanism will reflect the increase in value, or if the input materials or a particular economic good of higher order (capital) becomes more scarce, then the overall cost will be reflected in the equilibrium of value in relation to consumer demand and the supplies available to producers.

The monetary inflation occurs, when the central bank expands the rate of credit artificially through the expansion of the money supply, or beyond the money supply, causing interest rates to be set artificially low; this results in false signals being sent to investors, entrepreneurs and producers as to the degree of real, loanable funds available, and is the starting point of an economic “boom”; this could also be referred to as an “inhale” within the economy.

The economic boom or “inhale” cannot be maintained for long however, as the rates have been kept artificially low in relation to the expansion of credit and the money supply; this as stated, sends false signals to investors as to the funds available for production such as housing construction, the purchasing of capital such as labour, land, materials, machines etc. As those seeking further expansion continue to reach for resources, it is revealed that there are too few; leading to interest rates rising and the capital developed to become devalued; resulting in an economic bust, which can be referred to as an “exhale” in the economy.

The economic bust is a painful process, however it is highly necessary in order for rates of value to meet in a position of equilibrium, and stabilise the economy in relation to real loanable funds available reflected in the rates of interest, and allow the pricing mechanism to signal the actual value of economic goods in relation to consumer use value and producer exchange value.

We can think of the boom and bust cycle as breathing. We all breath (hopefully) inhaling and exhaling air, yet, if we were to take a deep breath in an attempt beyond what our lungs are capable of, and withhold from exhaling, we would slow the process of relief and do damage to our lungs. The boom and bust cycle can be seen in a similar way; the boom is the problem; the boom is an excessive intake of air, the bust is the readjustment back to a stable, natural rate. Yet many policy makers insist in bringing relief to the economy in the form of stimulus; this is folly, as the stimulus is just more of the same, perverse incentives and false signals, delaying the recovery period and prolonging the pain (this faulty activity in our breathing example can be seen as an attempt to hold the excessive air in the lungs, as a way of “strengthening” the lungs for a better recovery. There is only one method of recovery. Exhale!)

Inflation is not just a simple act of expanding the money supply however. A money, any money at the end of the day is an economic good, and is subject to the laws of supply and demand, as well as the first rule of economics: All goods are scarce.

What defines a good as an economic good, and to that extent, whether it holds any economic value at all, is whether it holds a demand which aims to satisfy a human need, want or desire, and whether or not the good in question is scarce. If the good in question falls into these two categories, then it is an economic good. What form of economic good it is and what its value is in relation to, is reflected in whether it serves a direct need (such as food), or an indirect (tools for cooking food); the good which serves direct consumption is an economic good of lower order, and the good which serves to better the ability to serve the need; tools for cooking, cars, materials and labour for making cutlery, are economic goods of higher order.

With Regards to a money, if it loses one or both of these characteristics, the money in question will cease to hold any value; if people no longer demand the commodity deemed as a money, its rate of value will decrees as people no longer hold it to a standard to which it serves a need, if the money ceases to be a scarce good, it will lose all economic value.

That which is stated above, is an extreme format known as hyperinflation. But, a monetary inflation of the magnitude we are used to in a fiat world is not therefore, less dangerous.

The process of inflation is not as simple as: more money is printed followed by lower value; there are many areas in between this process.

When government expands on the money supply, the new money is used to stimulate economic activity to which the economy cannot afford. The early receivers of the new money benefit from the influx, as they will be able to enact projects such as construction at unaltered prices. As the new (bad) money continues to pass through the economy, the prices of goods and services begin to reflect the decreased value of the money in question, causing the late receivers to be worse off, as their money has become less valuable with the artificial increase in supply.

This is why there is a tendency for prices to not increase straight away from inflation. However even the term “price increase from inflation” is a faulty one it must be admitted; the price of goods have not seen an increase, the money used for the means of exchange has seen an overall drop in its value, the prices have not increase but are merely reflecting a decrease in exchange value of the commodity used for trade.

One fallacy which I will briefly go over, is that wealth is simply a measure of the degree of money an individual holds possession over.

This however is completely false.

Wealth is not determined by the degree of money in a man’s pocket; nor is it necessarily a significant calculation of wealth. Wealth is based on the degree of economic goods; both of higher and lower order, to which an economizing individual holds command over.

It is the use value of the economic goods, their time frame, and their ability to serve a need to which the individual recognises, as a need he wishes to have satisfied.

If it were true, that wealth is simply determined and measured by the quantity of money in a man’s pocket, then we should be praising the outcomes of inflation, and ultimately striving for hyperinflation. Under this notion, Germany during its dark period of hyperinflation should have been considered the wealthiest nation of all time; everyone had barrels full of thousands of paper money notes.

Inflation is not just a monetary disaster; inflation is the theft of value.

It is the loss of opportunity for a higher standard of living for all economizing individuals. By increasing the money supply for the purposes of “short term gains”, the central bank and the government steals the possibilities of our means of exchange, by reducing the scarcity, and overall how valuable the good in question is in the long term. Central planners love the prospect of inflation because it provides them the ability to hold further control over the monetary system, and increase spending without increasing production and productivity.

Overall, with this fallacy at its end, I hope the reader will be left with the understanding that, with the creation of this monolithic institution known as the central bank, and the means of inflating the money supply; the creation of the fiat currency and its monopolistic hold, the central bank and the government have bestowed upon themselves control over the monetary system.

Whereas in the past money was a creation of the market, and as a market commodity for exchange aided in building upon the relationship between consumers and producers; now, under the fiat, government owned system, that relationship has shifted. With government solely in control of money, who may acquire it, how it may be used, who has theirs decreased or increased both in quantity and value, that relationship has turned to one between the establishment, and whoever it can gain the most from; whether that be consumers or producers and whichever is not chosen, is the one who suffers.

“the creation of the central bank and the enacting of the fiat currency, the power to print limitless quantities and act as a mafia towards the individual’s means and ability for exchange; forever weakening our lives and value”

The State has brought to itself the legal monopoly not just that of money production, but the power to define a money and through the elimination of the gold standard, the creation of the central bank and the enacting of the fiat currency, the power to print limitless quantities and act as a mafia towards the individual’s means and ability for exchange; forever weakening our lives and value.

If we truly want to end Cronyism and all it encapsulates; we need to restore the gold standard with a stable form of money substitute as a market commodity, not a symbol of “national sovereignty” to be centralised; we need to destroy the Central Bank.

Josh L. Ascough is on Instagram at https://www.instagram.com/j.l.ascough/

Image from https://pixabay.com/photos/london-bank-of-england-england-2427129/