From our Friends at the TaxPayers’ Allaince….

On Saturday The Times reported that the stamp duty increases brought in by former chancellor George Osborne have resulted in a decrease in stamp duty revenue.

According to The Times: “The tax raised £1.999 billion in the third quarter of 2015, before Mr Osborne introduced an additional 3 per cent surcharge for second home-buyers and landlords.

“Receipts were even lower in the first quarter of this year, at £1.883 billion. Receipts peaked at £2.61 billion in the third quarter of last year, according to the HMRC figures.”

The TaxPayers’ Alliance has long campaigned for the abolition of stamp duty. We first suggested it in 2012 as part of the 2020 Tax Commission report. Reforms we called for in 2014 reduced the burden on hard-pressed taxpayers, but failed to end the damage caused by stamp duty.

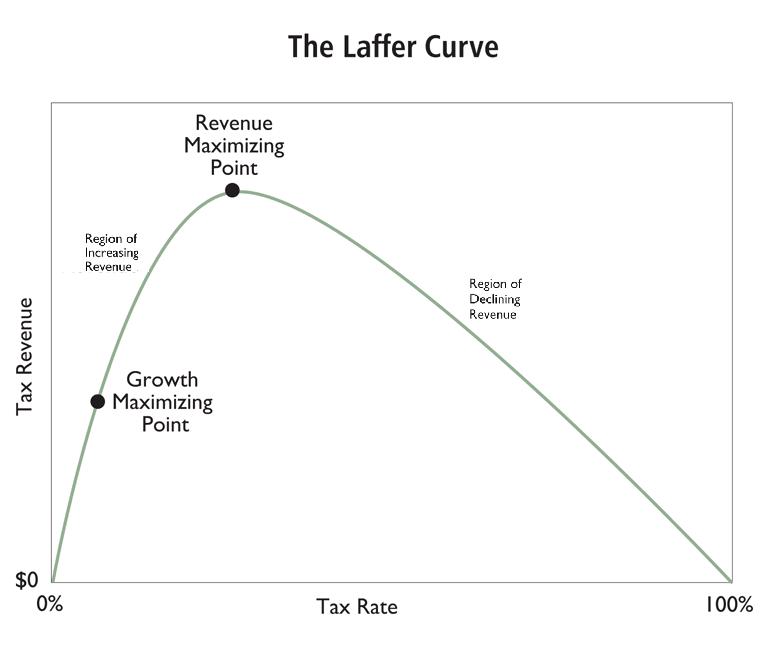

It is clear that stamp duty is a hindrance to many buyers and the government needs to reconsider its position and make positive changes to benefit the housing market. As data from the United States shows, tax cuts have resulted in significant investment by business and wage rises for workers. When income and corporation tax were reduced in the UK, revenues increased by 37 and 25 per cent respectively.

Put simply, tax cuts can help grow the economy and bring in greater revenue to pay for world class public services.